You Must Establish Credit To Buy A House

The experian website outlines how to interpret your fico score: Make sure that you’ve organised your finances before making an offer for a house or bidding at auction.

Budgeting Tips for First Time Home Buyers Build A Strong

Establish or improve your credit.

You must establish credit to buy a house. If you don't need the apartment right away, spend a few months building a credit history or improving your credit. To build your credit history, consider applying for a secured credit card or a. You must ensure that you can cover the deposit for the house if your bid or offer is successful and the remaining money must be available for settlement.

If you are a victim of identity theft, you are only responsible for paying back half of the debt. Advantages & disadvantages of putting a house in a trust. What credit score do you need to buy a house?

Take a look at the pros and cons of creating a trust before you put your house into it. After a bankruptcy, you may find that many of your old accounts are completely wiped off your credit report. Having a large down payment may slow down the process of getting your house.

A credit rating like this enables you to buy almost anything. Which of the following is not a factor in determining a fico score? As the trust must file tax.

The amount you saved for the down payment should also influence the house you buy. The options below may be a good place to start. If you have enough to put 20% on one home but 10% on another, the cheaper home will give you more bang for your buck.

While it varies by area and type of loan, generally lenders will look for a credit score of 660 or higher to grant a mortgage. This is the number used to identify a business entity for tax filing and reporting purposes. Next, you will need to apply for a tax identification number, also known as an employer identification number.

Some people will tell you that a new car is the best way to rebuild your credit. Resist the urge to buy a car. Before you establish business credit for the first time, the first step is to structure your business as a separate legal entity.

You can use your credit card to make purchases, and they are very convenient. Apply for a secured credit card. The problem is, because of your recent foreclosure, your interest rate is going to.

Having the ability to borrow funds allows us to buy things we would otherwise have to save for years to afford: But be aware that it usually takes many years to develop a fico score that is this high. Here are some basic steps you can take to begin rebuilding your credit:

And have the tools you need, you can start to establish your credit. One way to start a credit history is to have one or two department store or gas station cards. You could establish creditworthiness through things like utility payments, rent payments, insurance payments, and.

Once you understand how credit works in the u.s. Options for renting an apartment when you have bad or no credit. For most loan types, the credit score needed to buy a house is at least 620.

The following tactics can help you rent a house or apartment with poor credit or no credit history. To determine how much you must pay to buy out the house, add your ex's equity to the amount you still owe on your mortgage. You may also need to pay closing costs.

If you want to establish a credit history, check your credit report first, to make sure you don’t already have one. Buy online or over the phone where cash may not be an option. Most milestones in life, such as buying a house or leasing a car.

Homes, cars, a college education. Paying cash for all purchases. A home loan is almost always required to buy a house.

Secured credit cards are similar to a regular credit card, but they‘re backed by a deposit that helps protect the credit card issuer. How to establish, use, and protect your credit what you need to know good credit is valuable. Basic requirements to buy a house:

A credit card may be a good way to start building credit. You must establish credit in order to buy a house. But higher is better, and borrowers with scores of 740 or more will get the lowest interest rates.

If you don't have a credit score, you will probably need to make a 20 percent down payment to buy the house. You may have heard the saying, 'to get credit, you need to have credit' — which can be pretty frustrating as a credit newbie. For example, if you're going to buy a $175,000 house, you'll probably need at least $35,000 saved for your down payment.

Mycreditclassroom's checklist to improve your finances

40+ Subway Paving To Kitchen & Bathroom Ideas

Have you ever experienced stress? There's a smarter way of

Checklists You Should Do Before Taking Possession of a New

Agent Tips Using Testimonials To Win New Clients 100

Maskiell_HillsideCres_Bath2_01.jpg Interior, Bathroom

beer and pretzels casserole (With images) Easy casserole

newbathroommodel (With images) Pink bathroom tiles

Retirement Resources Women laughing

Visa vs. Mastercard Which Should You Use for Online

We all need money, but don't to live your life

Think you can't buy a house because you need a high credit

How to Build Credit History When Renting an Apartment

CTRL+ALT+DEL Coffee Cup Set Cupping set, Top kitchen

Florezas Kapsalon ideeën, Kapsalon interieur, Haarsalon

The Best Duplex House Elevation Design Ideas you Must Know

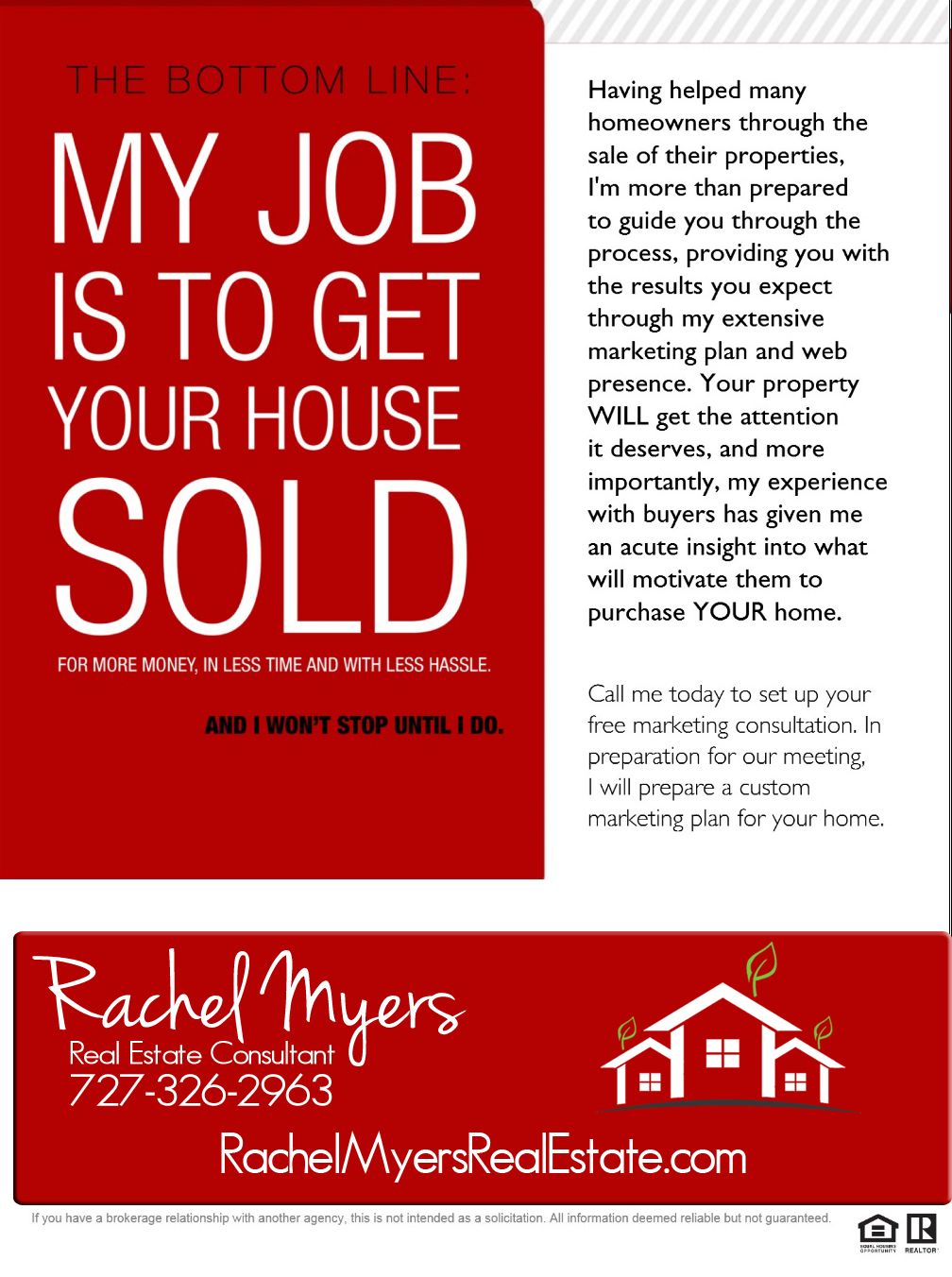

It's my job to get your house SOLD. Selling house, How

contemporary bathroom design, modern bathroom decorating

Pin by Michelle on interiors Penny tiles bathroom, Penny

Comments

Post a Comment